Land Value Surge in 2024: Insights for Foreign Investors in Tokyo and the Kanto Region

Key Points:

- Metropolitan Area Focus

- Economic Trends

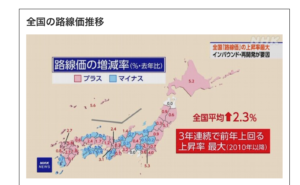

On July 1(2024), the National Tax Agency announced the land value(路線価)

as of January 1, showing a national average increase of 2.3%,

marking the third consecutive year of growth.

This rise, the largest in 16 years, is driven by the recovery of inbound tourism,

redevelopment projects, and increased housing demand.

Regional Highlights:

The average land value increased in 29 prefectures, with the highest increases in:

- Fukuoka: +5.8%

- Okinawa: +5.6%

- Tokyo: +5.3%

- Hokkaido: +5.2%

- Miyagi: +5.1%

- Aichi: +3.2%

- Osaka: +3.1%

- Saitama: +2.1%

Notable increases by tax office area included:

- Hakuba Village, Nagano Prefecture: +32.1%

- Kikuyo Town, Kumamoto Prefecture: +24.0%

- Nishi Ward, Osaka: +19.3%

Additionally, Shinsaibashi in Minami, Osaka, saw a significant rise of over 10% from a flat rate last year.

Ginza 5-chome in Tokyo’s Chuo Ward remained the highest land value in Japan for the 39th consecutive year

at 4,424 million yen per square meter, a 3.6% increase.

Comparative Insights:

Some areas have seen more than double the increase compared to 2014.

For example, Kanagawa Ward and Kohoku Ward in Yokohama experienced a 3.15 times rise.

Expert Insights:

One industry analyst attributes the rise to the recovery from the COVID-19 pandemic,

which boosted inbound tourism and demand for central housing and office spaces.

He predicts that unless there is a sharp rise in interest rates or a major shift in the global economy, land prices will remain stable.

Another expert at the Real Estate Economic Institute,

highlights that increased costs for labor and materials have driven up apartment and detached house prices.

The trend is expected to continue, particularly in areas near stations due to intense land competition.

Real Estate Insights:

Investment Potential:

Areas with high land value increases, like central Tokyo and Yokohama,

present strong investment opportunities due to ongoing redevelopment and high demand.

Market Trends:

The rising costs of labor and materials are likely to continue driving up property prices,

particularly for apartments and detached houses near transport hubs.

Future Outlook:

The competition for land in prime locations is expected to intensify,

further pushing up prices.

Investors should consider the impact of exchange rates and interest rates on their purchasing power.

For those involved in real estate transactions, it is crucial to monitor these trends

and consider the long-term potential of properties in rapidly appreciating areas.

Understanding the driving factors behind land value increases can help in making informed investment decisions and anticipating market shifts.

Conclusion:

The 2024 land value data shows significant increases in the Kanto region, particularly in Tokyo, Kanagawa, Chiba, and Saitama, due to economic recovery

and redevelopment.

For foreign investors, these trends indicate strong investment opportunities in the Kanto region and other rising areas.

Understanding the factors driving land value increases and expert insights can help in making informed decisions in the real estate market.

* Regional data for each prefecture (from NHK)

Source:

https://www3.nhk.or.jp/news/html/20240701/k10014498061000.html

Toshihiko Yamamoto – Founder and Lead Broker, Yamamoto Property Advisory

Toshihiko Yamamoto is the founder and principal broker of Yamamoto Property Advisory,

a distinguished real estate brokerage in Tokyo that specializes in luxury residential and investment properties for an international clientele.

His firm caters to discerning investors seeking premier properties for personal use and income-generating whole buildings for investment purposes.

A licensed real estate broker in Japan, Mr. Yamamoto holds an MBA from Bond University in Australia

and a Certified Commercial Investment Member (CCIM) designation from the CCIM Institute in the United States.

His extensive international experience, having lived abroad in Australia and the United Kingdom, equips him

with a nuanced understanding of global real estate trends and the unique needs of foreign investors.

With over two decades of experience in international business, Mr. Yamamoto has successfully conducted business with clients from more than 20 countries.

As a seasoned property investor himself, he provides informed guidance to his clients as they navigate the intricacies

of the Japanese real estate market to secure optimal investments.

Discover more in his book, “The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage,

and Sell Real Estate in Japan,” available on Amazon, iBooks, and Google Play.

Connect with us through social media on Instagram, WhatsApp, and LINE for further information and expert assistance.

About the book

Amazon.com Link