Happy new year 2019 ! Year of Boar.

New year has just begun and I would like to quickly review the market using some statistics.

The data always tells you the fact. How to read the data is a key for success.

It is too early to know if housing is in another bubble in Japan (I don’t think so)

It will depend on what happens with the global economy. Unfortunately, bubbles are only recognized with 100 percent certainty

in 20/20 hindsight.

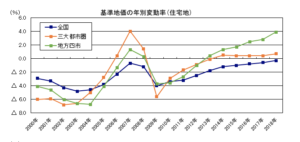

The national average standard price of land

According to the government announcement, the national average standard price of land (基準地価) published in September 2018

by the Ministry of Land, Infrastructure and Transport, land lots for all uses excluding forest lands nationwide

went up by 0.1% compared with the previous year, rising for the first time in 27

years since 1991. The average rate of residential areas was down 0.3% nationwide, falling for 27

consecutive years, but the rate of declines shrank 0.3% from the previous year

Regional areas (non-metropolitan areas) declined 0.8%, but the three major

metropolitan areas(Tokyo, Osaka, Nagoya) went up by 0.7% for the fifth

consecutive year. In addition, the second tier metropolitan cities (Sapporo, Sendai,

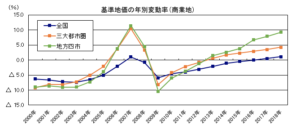

Hiroshima, Fukuoka) went up by 3.9% for the sixth consecutive year. On the other hand, the commercial real estate grew 1.1% on a nationwide average for the second consecutive year.

The three metropolitan areas have risen for the sixth consecutive year, and the rate is 4.2%, plus 0.7% over the previous year.

Regional areas continue to decline, but the decline is only 0.1%, down 0.5% from the previous year.

In addition, the four major cities grew by 9.2%, and the rise was 1.3% over the previous year.

One industry expert says

“The bipolarized tendency has emerged between metropolitan areas and regional areas and even in the same city the situation where bipolarized tendency is progressing

between the central part where people, goods and money are attracted and the peripheral parts (of the central part) are not changing fundamentally.

Now let’s look at the price movement of key market segments.

Here is the historical chart of the price movement. The charts show the growth ratio of each year vs.previous year.

Tokyo and all other areas are presenting the healthy growth.

Blue : Nation average

Orange : Three metropolitan areas (Tokyo, Osaka, Nagoya)

Green (Four major regional cities-Sapporo, Sendai, Hiroshima, Fukuoka)

(residential lands)

(commercial lands)

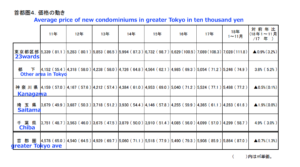

1 New condos market in Greater Tokyo area

Fudoson Keizai Kenkyusho (Real Estate Economic Institute) in Tokyo has made a report on the recap of

2018 market and forecast of 2019 in Greater Tokyo area (Tokyo, Kanagawa, Saitama, Chiba)

Here is the brief summary.

Supply

Condominium supply in 2019 will go sideways at 37,000 units which is slightly up 0.8%.

The impact of consumption tax increase from 8% to 10% in October 2019 is limited.

In 2018, the total supply of new condos was estimated to be 36,700 units, an increase of 2.2% over the previous year.

The price of new condos has been kept at high side and it has increased for the second consecutive year.

The impact of consumption tax increase will be neutralized by the extension of housing loan tax reduction for 3 years.

Projects

The Tokyo central wards is seeing the large-scale development along the water front area such as the Olympic Village.

The outskirts of Tokyo metropolitan area expects to see some redevelopments projects near the major railway stations.

In Kanagawa prefecture, the number of supply will increase 9.0% to 8,500 units, In Saitama prefecture, also the number will of supply

will increase 4.7% to 4,500 units.

Inventory

Inventory (unsold units) of new condos is stable at 6,000 units.

Inventory at the end of November increased by 8.2% year on year to 6,749 units, sharp increase in November.

Construction started in 2018 to January-October decreased by 22.2% to 43,784 units.

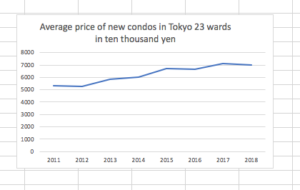

The average price from January to November 18 is 58.644 million yen, which is at high side, almost the same level as the same period last year

(58.84 million yen).

(Statistics by each prefecture)

(Average price of new condos in Tokyo 23 wards)

(Average price per m2 of new condos in Tokyo 23 wards)

2 Pre-owned condo in Greater Tokyo

According to a report by Tokyo Kantei, in November 2018, the price of second-hand condominiums in the Tokyo

metropolitan area (greater Tokyo) was up 2.3% from the previous month, rising for the first

time in three months. It was the highest level in 2018.

By prefecture, in Tokyo (+ 1.4%, 49.46 million yen), Kanagawa (+ 1.7%, 29.22

million yen) and Saitama (+ 1.4%, 23.1 million yen) showed that. Meanwhile, in

Chiba Prefecture, it is minus 0.5% to 20 million yen, and the price has been

down for s few months,

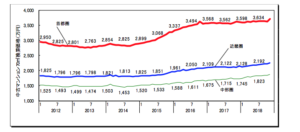

The chart shows the price trend of average price of second-hand condos in Tokyo

and surrounding prefectures (Kanagawa, Saitama, Chiba) from 2012 and 2018.

(In red) and Kinki area (Osaka and surrounding prefectures) in blue and Chubu area (Aichi and surrounding prefectures) in green

The price above the chart shows the average price of condos sold in 10 thousand yen for 70m2 size unit.

As the charts show, the price of second-hand condominiums in Tokyo has been grown since 2014 but the rate of

growth in last few years is becoming slim and almost flat.

Office market in Tokyo

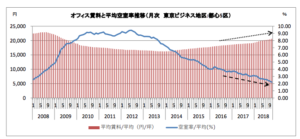

The following chart shows the office rent and vacancy rate in Tokyo central areas between 2008 and 2018.

Office rent in Tokyo 5 central wards in October 2018 surpassed the previous year for 54 consecutive months,

a year-on-year comparison + 8.2%.

The vacancy rate improved continuously for 73 consecutive months, improving by 0.8p from the previous year.

Another report says commercial real estate market including office use is very strong in all big cities (Tokyo, Osaka, Nagoya, Kobe, Kyoto, Fukuoka)

International landscape

The following chart is indicating the index of high end condo in major global gate ways cities as of October 2018

(By Japan Real Estate Institute)

I believe Tokyo is still underrated compared with other global major cities. I can’t imagine that condos in Taipei, Shanghai, Singapore are much more expensive than those in Tokyo.

Final thought

Compared to the forecast on number of households based on the 2010 National Census, the peak will shift from 2019 to 2023 and number of households will increase

by 2.25 million in 2030 (National Institute of Population and Social Security Research)

The characteristic of the current very strong real estate market is caused by the fact that domestic and overseas high net worth individuals

have entered into real estate investment.

It is not comparable with the previous bubble era. Inheritance countermeasures using real estate are also active, and such pure investment

and individual money of tax saving are moving the market to a certain extent in some areas such as urban areas.

Overall, the residential segment is definitely slowing down because the price has gone up too quickly and

thus the affordability is diminishing. It is also said that major developers such as

Mitsui Fudosan and Sumitomo Fudosan are facing tougher time to sell their new condos (high rises in bay area etc)

in Tokyo and their real inventory is increasing.

That is why the supply of new condos is gradually slowing down.

In the meantime, the commercial segment is still very strong.

In my opinion, the overall residential market is reaching the peak but the prime locations should have room to grow further due to

the relative price competitiveness in the global landscape. Interest rate in Japan will be kept at very low

by the central bank making the cap rate attractive for the major global investors. (The cap rate is declining though)

Some more foreign investments by the world-class developers and equity funds may come in 2019 before the cap rate

economically makes no-sense. The number of accommodation facilities and area of floor space continues to expand owing to a

stable economic environment and growing demand for accommodations.

These global investment would focus on commercial real estates such as large office buildings and hotel developments in Tokyo.

One big caveat is the global recession.

Housing could be heading for its bad year since the last housing crash in 2008 if the serious global recession takes hold.

Other Helpful Articles

Japan market update. How are big players betting ? : Is it in the state of bubble ?

Where is the most attractive city to invest in Asia ? : CBRE institutional investors reports 2018

Toshihiko Yamamoto

Real estate investing consultant and author.

Founder of Yamamoto Property Advisory in Tokyo.

International property Investment consultant and licensed

real estate broker (Japan).

He serves the foreign companies and individuals to buy and sell

the real estates in Japan as well as own homes.

He holds a Bachelor’s degree in Economics from

Osaka Prefecture University in Japan

and an MBA from Bond University in Australia

Toshihiko’s book, “The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage and Sell Real Estate in Japan”is now out on Amazon, iBooks (iTunes, Apple) and Google Play.

About the book

Amazon.com Link