The Japanese Housing Market: Is it Time to Buy?

The prices of newly built standalone homes and condominiums in Japan

have been rising steadily for the past few years,

but there is a growing concern that the market may

be reaching a turning point.

The prices of newly built standalone homes and condominiums

have been rising steadily for the past few years.

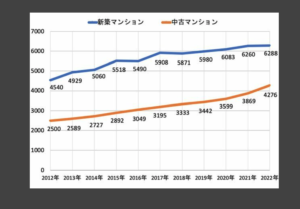

The price of used condominiums has increased by more than 70% over 10 years.

The rise in condominium prices, especially in the metropolitan area, continues.

However, there is a growing concern that the market may be reaching a turning point.

A recent survey by the Japan Real Estate Brokers Association (JREBA) found that

while the majority of industry insiders believe that prices will continue to rise in the short term,

there is a growing concern that the market may be reaching a turning point.

According to the Eastern Japan Real Estate Distribution Organization (REINS East Japan),

the average transaction price of used condominiums

in the metropolitan area was 25 million yen in 2012

and reached 42.76 million yen in 2022.

This is an astonishing rise of about 71% over the past decade,

nearly twice the rise in new condominiums.

Detached house prices have been skyrocketing over the past two years.

The price of new detached houses, which was 34.19 million yen in 2012,

rose to 41.28 million yen in 2022, an increase of 20.7% during this period.

Used detached houses went from 29.17 million yen to 37.53 million yen, a 28.7% increase.

The price of new detached houses, which was 34.19 million yen in 2012,

rose to 41.28 million yen in 2022, an increase of 20.7% during this period.

Used detached houses went from 29.17 million yen to 37.53 million yen, a 28.7% increase.

The rate of increase for both is lower compared to condominiums.

However, although prices had been relatively flat until 2020,

the rise over the past two years has been striking.

One of the main reasons for the recent surge in prices is the low-interest rate environment,

which has made it more affordable for people to borrow money and buy homes.

However, as interest rates start to rise, this could put a damper

on demand and lead to a decrease in prices.

Another factor that could contribute to a slowdown

in the market is the rising cost of construction materials.

The price of steel, concrete, and other materials has been on the rise in recent months,

which is making it more expensive to build new homes.

This could lead to builders reducing the number of homes they are constructing,

which would in turn lead to a decrease in supply and an increase in prices.

Overall, it is still too early to say for sure whether prices

will drop in the next three months.

However, the factors mentioned above suggest that there

is a growing risk of a slowdown in the market.

If you are considering buying a home, it is important to be aware of

these risks and to factor them into your decision-making process.

Here are some additional details about the factors that

could contribute to a slowdown in the housing market:

Low-interest rates:

The Bank of Japan has kept interest rates at a record low of -0.1%

for several years.

This has made it very cheap for people to borrow money,

which has helped to drive up demand for homes. However,

as the economy recovers and inflation picks up,

the BOJ may be forced to raise interest rates.

This would make it more expensive to borrow money,

which could lead to a decrease in demand for homes.

The rising cost of construction materials:

The price of steel, concrete, and other materials has been on

the rise in recent months.

This is due to a number of factors, including the global economic recovery

and the war in Ukraine.

The rising cost of construction materials is making it more expensive

to build new homes, which could lead to a decrease in supply and an increase in prices.

The shrinking population:

Japan’s population is ageing and shrinking.

This means that there are fewer people who are able to buy homes.

As the population continues to shrink, the demand for homes is likely to decrease,

which could lead to a slowdown in the housing market.

Overall, there are a number of factors that could contribute

to a slowdown in the housing market in Japan.

If you are considering buying a home, it is important

to be aware of these risks and to factor them into your decision-making process.

Summing up the above, it seems that many industry insiders believe that

in the future housing market

while new constructions will continue to rise, used houses are likely to peak sooner or later.

From the perspective of these real estate companies,

people who are considering buying a new house

may want to buy sooner rather than later, before further price increases.

However, if a used house is acceptable, given the potential for prices to fall,

it might be a good idea to wait a while and consider the timing of your purchase.

Condo

Blue: New

Orange: Used

House (detached house)

Blue: New

Orange: Used

Source: Yahoo article

Insight

The housing market in Japan is at a crossroads.

The prices of newly built standalone homes and condominiums

have been rising steadily for the past few years,

but there is a growing concern that the market may be reaching a turning point.

There are a number of factors that could contribute

to a slowdown in the housing market,

including rising interest rates, the rising cost of construction materials,

and an ageing and shrinking population.

If you are considering buying a home, it is important to

be aware of these risks and to factor them into your decision-making process.

Here are some tips for buying a home in a rising market:

Get pre-approved for a mortgage before you start looking at homes.

This will give you an idea of how much you can afford to

spend and will make the buying process go more smoothly.

Be prepared to act quickly.

In a rising market, homes tend to sell quickly,

so you need to be prepared to make an offer as soon as you find a home you like.

Be willing to compromise.

In a rising market, you may not be able to get everything you want in a home.

Be prepared to compromise on things like location, size, or features.

Buying a home is a big decision,

and it is important to do your research and be prepared

before you start the process.

By following these tips, you can increase your chances of

finding a home that you love in a rising market.

If you are a foreign investor considering buying a home in Japan,

it is important to be aware of the factors that could contribute to a slowdown

in the housing market.

By understanding these risks, you can make an informed decision

about whether to buy a home now or wait until the market stabilizes.

If you are ready to start your home-buying journey,

I would be happy to help you.

I have over 10 years of experience

in the Japanese real estate market and

I know how to help foreign investors find the perfect home.

Contact us today to learn more about my services.