Understanding Tokyo’s Real Estate Market in 2024: High Risk, High Opportunity

The UBS Global Real Estate Bubble Index 2024 delivers a comprehensive analysis of real estate markets across the globe,

evaluating the risk of real estate bubbles

by examining key factors such as price-to-income ratios, mortgage rates, and overall economic imbalances.

The report presents a mixed global landscape, with notable regional variations, and Tokyo emerges as one of the highest-risk markets.

For foreign investors interested in Japan’s capital, understanding the dynamics at play is essential for making informed decisions.

Global Trends in 2024

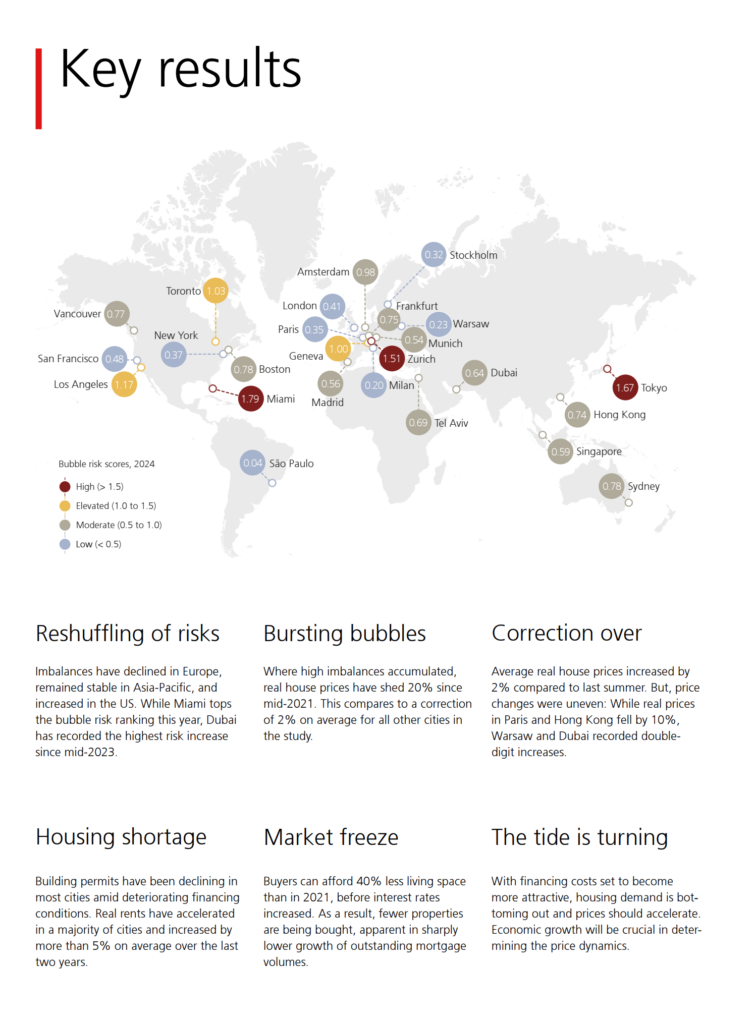

The overall risk of housing bubbles has slightly decreased for the second year in a row,

but this reduction is not uniform across regions.

Europe has seen a decline in risk, while Asia-Pacific markets have remained relatively stable, and risks have risen in the US.

- Miami ranks highest in bubble risk, followed by Tokyo and Zurich.

- Elevated risks also appear in Los Angeles, Toronto, and Geneva.

- Frankfurt, Munich, and Stockholm, previously high-risk cities, have experienced significant price corrections that have lowered their risk profiles.

Despite high risks in certain areas, the stabilizing influence of housing shortages—especially in urban markets—has played a major role

in sustaining high property values,

even amid rising interest rates and inflation.

Key Drivers Shaping Tokyo’s Real Estate Market

1. High Bubble Risk

Tokyo stands out as one of the cities with the highest risk of a real estate bubble, with a score of 1.67.

This score reflects a significant disconnect between housing prices and local incomes.

Over the last five years, Tokyo’s real estate prices have surged by more than 30%, outpacing rental growth.

This sharp increase positions Tokyo among the top high-risk cities globally.

2. Drivers of Price Growth

Tokyo’s robust price growth is driven by multiple factors:

Urbanization continues to concentrate populations in major cities, increasing housing demand.

Rural depopulation has pushed more people towards Tokyo for work and lifestyle opportunities.

Foreign investment has risen sharply, particularly as the weak yen has made Japanese properties more affordable for overseas buyers.

This has further inflated prices.

Though financing costs have increased slightly, they remain lower than in many other global markets, keeping demand strong.

As a result, the Tokyo market continues to attract significant investment, particularly from foreign buyers who are capitalizing

on favorable exchange rates.

3. Affordability Challenges

Tokyo has one of the highest price-to-income ratios globally, meaning housing prices are significantly disconnected from local earning capacity.

For many residents, purchasing property is becoming increasingly out of reach, with demand largely being driven by foreign buyers and investors rather than local consumers.

This raises concerns about long-term sustainability.

4. Rising Rents and Housing Shortages

Real rents in Tokyo have increased by over 5% in the past year, further exacerbating the affordability crisis.

Compounding the issue is the severe housing shortage.

New construction has not kept pace with demand, leading to fierce competition for existing properties.

Despite the high risk of a bubble, prices continue to rise due to the scarcity of available homes, with little relief in sight.

Macroeconomic Influences on Tokyo’s Market

1. Loose Monetary Policy

Tokyo’s high property valuations are, in part, a side effect of Japan’s long-standing loose monetary policy.

The Bank of Japan has maintained historically low interest rates, which have encouraged borrowing and sustained high demand in the real estate market.

Even as prices have climbed to unsustainable levels compared to local incomes, these low rates have allowed buyers to continue entering the market.

2. Foreign Demand

The weak yen has made Tokyo’s real estate particularly attractive to foreign buyers.

This influx of international capital has further decoupled Tokyo’s property market from local incomes, as foreign buyers benefit from currency advantages

and are less sensitive to the price-to-income imbalance affecting Japanese residents.

Is Tokyo Heading for a Real Estate Bubble?

The sustainability of Tokyo’s current prices is questionable.

The UBS report warns that despite strong demand, Tokyo is vulnerable to a market correction due to its significant price-to-income imbalance.

If key macroeconomic conditions—such as financing costs or foreign investment—shift, Tokyo could experience a downturn in real estate prices.

However, the ongoing housing shortage and rising rents might help mitigate the impact of a sharp price correction, at least in the short term.

A potential price correction could have significant economic consequences, particularly for heavily leveraged investors and property owners.

Still, given Tokyo’s strong demand and limited supply, the market may continue to experience upward price pressure in the near future.

Broader Asia-Pacific Market Trends

1. Hong Kong

Hong Kong has seen one of the most significant price corrections, with inflation-adjusted house prices returning to 2012 levels.

Although the market has cooled considerably, economic growth and easing interest rates could stabilize the market in the coming quarters.

2. Singapore

Singapore’s real estate market shows a moderate bubble risk.

Strong rental growth has outpaced property prices, but government cooling measures have helped reduce foreign demand, particularly in the luxury sector.

The report predicts moderate price inflation as unsold inventory rises.

3. Sydney

Despite being one of the least affordable cities globally, Sydney has seen a slight increase in real house prices due to a pronounced housing shortage.

The bubble risk remains moderate, and prices are expected to rise further as interest rates decline.

What Does This Mean for Foreign Investors?

Tokyo presents both high risk and high reward for foreign investors.

While the city’s housing market is facing bubble risks, it continues to offer strong capital appreciation potential,

particularly for those looking to take advantage of the weak yen and favorable financing conditions.

However, investors should remain cautious of the market’s imbalances, especially as changes in economic conditions could lead to a significant price correction.

Critical Considerations for Investors:

Long-term strategy:

Investors should focus on their long-term goals and assess their risk tolerance, particularly in light of the high risk of a real estate bubble in central Tokyo.

While property prices in Tokyo’s urban core have risen significantly, it’s important to remember that Japan as a whole faces a surplus of housing in rural areas,

which can provide alternative opportunities depending on the investor’s strategy.

Urban land scarcity advantage:

The scarcity of land for apartment buildings in central Tokyo, coupled with rising rents, creates an opportunity for investors seeking rental yields in prime urban locations. However, this is a localized issue specific to central Tokyo; the broader Japanese market is experiencing housing oversupply, which investors should consider when planning their investments.

Currency and financing dynamics:

The weak yen continues to offer a favorable entry point for foreign investors, making Tokyo real estate more affordable compared to other global markets.

However, rising financing costs and potential changes in economic conditions could shift the market dynamics over time,

especially if foreign demand decreases or monetary policies tighten.

Conclusion

The UBS Global Real Estate Bubble Index 2024 highlights Tokyo as one of the highest-risk real estate markets globally,

largely due to rising property prices driven by foreign demand, urbanization, and a shortage of available land for apartment buildings in the city center.

However, it is important to note that while central Tokyo faces significant land shortages for new condominium developments,

Japan as a whole is experiencing an excess of housing, particularly in rural areas.

This imbalance in supply highlights the unique dynamics of Tokyo’s market, where urban housing demand continues to push prices upward despite broader trends of

housing surplus in other parts of the country.

For foreign investors, this presents both an opportunity and a risk.

On one hand, central Tokyo remains an attractive market for capital appreciation and rental yields due to limited land availability.

On the other hand, the high risk of a price correction—driven by macroeconomic changes or shifts in foreign investment—must be carefully considered.

As a Tokyo-based real estate expert, I am well-positioned to help foreign investors navigate these complexities,

offering tailored advice on both the opportunities and risks within this unique market.

If you are a foreign investor interested in exploring high-value properties in Tokyo or other parts of the greater Kanto region,

now is the time to act.

I specialize in high end properties ranging from ¥50 million to ¥300 offering expert advice tailored to meet your investment needs.

Contact us today for a consultation and let’s discuss how you can leverage Tokyo’s dynamic market to your advantage.

For personalized guidance on navigating Tokyo’s high-end real estate market, reach out to Yamamoto Property Advisory today.

You can also contact me directly via Instagram, LINE, or WhatsApp by scanning the QR code below.

Let’s turn your investment goals into reality!

Source:

ubs-global-real-estate-bubble-index-2024

Toshihiko Yamamoto – Founder and Lead Broker, Yamamoto Property Advisory

Toshihiko Yamamoto is the founder and principal broker of Yamamoto Property Advisory,

a distinguished real estate brokerage in Tokyo that specializes in luxury residential and investment properties for an international clientele.

His firm caters to discerning investors seeking premier properties for personal use and income-generating whole buildings for investment purposes.

A licensed real estate broker in Japan, Mr. Yamamoto holds an MBA from Bond University in Australia

and a Certified Commercial Investment Member (CCIM) designation from the CCIM Institute in the United States.

His extensive international experience, having lived abroad in Australia and the United Kingdom, equips him

with a nuanced understanding of global real estate trends and the unique needs of foreign investors.

With over two decades of experience in international business, Mr. Yamamoto has successfully conducted business with clients from more than 20 countries.

As a seasoned property investor himself, he provides informed guidance to his clients as they navigate the intricacies

of the Japanese real estate market to secure optimal investments.

Discover more in his book, “The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage,

and Sell Real Estate in Japan,” available on Amazon, iBooks, and Google Play.

Connect with us through social media on Instagram, WhatsApp, and LINE for further information and expert assistance.