Rising Monthly Condo Fees in Japan: What Foreign Buyers Must Understand Before Investing

Introduction

Japan’s condominium market continues to attract global investors and foreign residents, thanks to its stability, location appeal, and urban infrastructure. However, one crucial aspect is often underestimated: the monthly ownership costs associated with condominiums.

If you are considering purchasing a condo in Japan, understanding monthly management fees and repair reserve funds is essential for long-term financial planning.

What Are Condo Management and Repair Fees in Japan?

In Japan, condominium owners pay two key recurring charges aside from mortgage payments and property taxes:

1. “Kanri-hi” (管理費, Management Fees)

These cover the daily operations of the building:

-

Salaries for building staff and managers

-

Cleaning and maintenance of shared spaces

-

Security and surveillance

-

Landscaping and utility costs for common areas

2. “Shuzen Tsumitate-kin” (修繕積立金, Repair Reserve Fund)

This is a long-term savings fund for large-scale repairs, such as:

-

Roof and waterproofing maintenance

-

Structural work

-

Elevator replacements

-

Painting and façade repairs

These fees ensure a building remains safe, clean, and livable—but they are increasing.

10-Year Trend: A Steady Climb in Monthly Costs

Over the past decade, both management fees and reserve funds have risen significantly.

Management Fees (2014–2023)

The average monthly management fee for a 60㎡ condo unit increased from ¥10,980 in 2014 to ¥14,715 in 2023—a 34% increase.

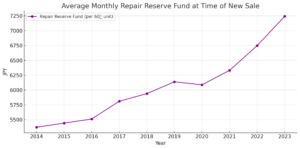

Repair Reserve Funds (2014–2023)

Monthly repair contributions rose from ¥5,373 in 2014 to ¥7,243 in 2023—up by about 35%.

Why Are Monthly Fees Rising?

Three key forces are driving this trend:

-

Labor Shortages

Building managers and janitorial staff are in short supply, pushing up wages. -

Material & Utility Inflation

Construction material prices and energy costs have soared, impacting maintenance budgets. -

Higher Amenity Standards

Modern buildings increasingly offer luxury features like gyms, lounges, guest suites, and rooftop terraces—raising long-term upkeep costs.

2024 Government Guidelines: A Turning Point

In February 2024, Japan’s Ministry of Land, Infrastructure, Transport and Tourism (MLIT) issued updated guidelines urging developers to set higher initial reserve fund levels.

These reforms aim to reduce the risk of underfunded buildings but also result in higher upfront monthly costs for buyers.

New vs. Old Buildings: Different Fee Models

-

New Buildings: Often use “step-up” pricing for reserve funds (low initially, increasing later)

-

Older Buildings: May face sudden spikes in fees if previous reserves were insufficient

Both pose different challenges, but the net cost over time may be higher than anticipated.

Case Examples: Fee Hikes and Owner Responses

-

Some property management firms are pulling out of underfunded buildings

-

A shift toward self-management has led to maintenance delays and quality issues

-

Owner resistance to fee increases sometimes undermines proper building upkeep

How Rising Fees Affect Foreign Buyers

Many investors focus only on purchase price and rental income. However:

-

Net yield is directly impacted by rising fees

-

Unexpected increases can hurt resale value or rental profitability

What to Check Before You Buy

Before purchasing a condo in Japan, careful review of the building’s financial and governance health is essential. We strongly recommend you:

-

Review at least 5–10 years of management and reserve fee history (available from the seller or agent)

-

Obtain and examine annual general meeting reports issued by the owners’ association; one meeting is held at minimum every year by law

-

Check the repair reserve fund budget and update history. If the fund has not been reviewed or revised in over 10 years, it may indicate that the management board or management company lacks awareness of inflation and long-term maintenance realities

-

Be cautious if the repair reserve budget appears outdated or unresponsive to recent market trends—this could impact the building’s long-term asset value

-

Confirm the current reserve fund balance and any upcoming large-scale repairs or capital projects

-

Examine the rate and number of delinquent households. While a few units in default may be acceptable even in well-run buildings, more than that could signal financial strain or poor governance

-

Investigate the reputation and performance of the management company, especially in terms of transparency, communication, and maintenance efficiency

These steps can help you avoid unforeseen costs and ensure that the property you invest in maintains its value over time.

Hold or Exit? Long-Term Strategy Matters

If you plan to own for more than 10 years, rising fees must be included in your cost model.

For some, early resale or downsizing may become a more strategic option.

Conclusion: Prepare Now to Avoid Future Surprises

The direction is clear: fees will continue rising.

To make smart property decisions in Japan:

-

Be aware of all costs—not just the sticker price

-

Choose buildings with stable, well-funded reserves

-

Get expert guidance before committing

How Yamamoto Property Advisory Can Help

At Yamamoto Property Advisory, we assist foreign clients with:

-

Detailed due diligence

-

Fee structure and reserve fund analysis

-

Strategic buy/sell decisions based on real market data

📩 Contact us to schedule a free consultation.

Reference:

https://prtimes.jp/main/html/rd/p/000000247.000018769.html

#JapanRealEstate

#TokyoPropertyMarket

#CondoInvestmentJapan

#ForeignBuyersJapan

#MonthlyCondoFees

#PropertyDueDiligence

#RealEstateCosts

#AssetManagementJapan

#JapaneseCondominiums

#InvestSmartJapan

Toshihiko Yamamoto is the founder and principal broker of Yamamoto Property Advisory,

a distinguished real estate brokerage in Tokyo that specializes in luxury residential and investment properties for an international clientele.

His firm caters to discerning investors seeking premier properties for personal use and income-generating whole buildings for investment purposes.

A licensed realestate broker in Japan, Mr. Yamamotoholds an MBA from Bond University in Australia

and a Certified Commercial Investment Member (CCIM) designation from the CCIM Institute in the United States.

His extensive international experience, having lived abroad in Australia and the United Kingdom, equips him

with a nuanced understanding of global real estate trends and the unique needs of foreign investors.

With over two decades of experience in international business, Mr. Yamamoto has successfully conducted business with clients from more than 20 countries.

As a seasoned property investor himself, he provides informed guidance to his clients as they navigate the intricacies

of the Japanese real estate market to secure optimal investments.

Discover more in his book, “The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage,

and Sell Real Estate in Japan,” available on Amazon, iBooks, and Google Play.

Connect with us through social media on Instagram, WhatsApp, and LINE for further information and expert assistance.

About the book

Amazon.com Link