Happy new year 2019 ! Year of Boar.

New year has just begun and I would like to quickly review the market using some statistics.

The data always tells you the fact. How to read the data is a key for success.

It is too early to know if housing is in another bubble in Japan (I don’t think so)

It will depend on what happens with the global economy. Unfortunately, bubbles are only recognized with 100 percent certainty

in 20/20 hindsight.

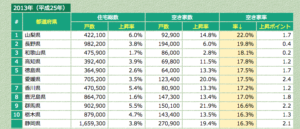

The national average standard price of land

According to the government announcement, the national average standard price of land (基準地価) published in September 2018

by the Ministry of Land, Infrastructure and Transport, land lots for all uses excluding forest lands nationwide

went up by 0.1% compared with the previous year, rising for the first time in 27

years since 1991. The average rate of residential areas was down 0.3% nationwide, falling for 27

consecutive years, but the rate of declines shrank 0.3% from the previous yearRead more