The End of “Cheap Tokyo”: A Deep Dive into the 5-Year Structural Shift of Japan’s Real Estate Market

Introduction: The Sleeping Giant Has Awoken

For the past decade, global investors have whispered about Tokyo as the world’s last great “undervalued” metropolis. While real estate prices in New York, London, Hong Kong, and Singapore skyrocketed to stratospheric levels, Tokyo remained surprisingly stable. A luxury apartment in Minato-ku could be acquired for a fraction of the cost of a comparable unit in Manhattan or Kensington.

However, new data released by Tokyo Kantei suggests that this era of price stagnation is emphatically over.

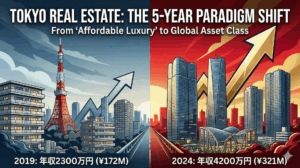

We have analyzed the “Required Annual Household Income for New Condominiums” in the Greater Tokyo Area, comparing the landscape of 2019 against 2024.

The results are not merely an update on inflation; they represent a fundamental structural shift in the Japanese property market.

In just five years, the “entry ticket” for Tokyo’s premier districts has effectively doubled. For international investors and expatriates residing in Japan, understanding this shift is no longer optional—it is critical for wealth preservation and strategic acquisition. But beyond the charts and graphs, this shift forces us to ask a deeper question: What is the true purpose of a home in post-pandemic Tokyo?