Rising Used Condominium Prices in Tokyo and Major Japanese Metropolitan Areas

Tokyo Kantei Press Released on March 23, 2023

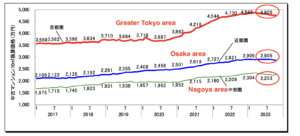

Major Cities in the Three Major Metropolitan Areas: Monthly Trends in Used Condominium Prices (70 sqm)

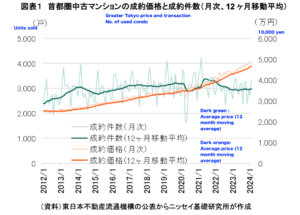

In February, used condominium prices in the Tokyo metropolitan area increased

by 0.4% compared to the previous month, reaching 48.66 million yen,

marking the third consecutive month of increase.

In central Tokyo, prices once again surpassed the 100 million yen mark.

The average prices in the Kinki and Chubu regions also continued to rise modestly,

with no significant downward movement seen in the market.

In February 2023, used condominium prices in the Tokyo metropolitan area

rose for the third consecutive month, with a slight increase of 0.4% compared to the previous month,

reaching 48.66 million yen.

When looking at the data by prefecture, Tokyo saw an increase of 0.7% to 64.41 million yen,

surpassing the record high set in December of the previous year.

In Kanagawa Prefecture (+0.4%, 36.68 million yen), prices continued to rise compared

to the previous month, while in Chiba Prefecture (+1.7%, 28.29 million yen),

prices have been on an upward trend since April of the previous year.

On the other hand, prices in Saitama Prefecture decreased slightly by 0.4% to 30.49 million yen,

marking the first decline in six months.

The average price in the Kinki region increased for the first time in two months,

with a slight increase of 0.2% to 29.14 million yen, due to the strength of the Osaka area.

In Osaka Prefecture, the price showed a similar movement with a 0.2% increase to 31.28 million yen,

but it did not surpass the level reached in December of the previous year.

Read more