Interested in buying a property in Japan where the country risk is lowest in the world ?

Japan is a rare Asian country insofar as it allows foreigners to buy a property. Foreigners can buy both land and building without special qualification. When it comes to buying a property here, Japan has very few restrictions than the Western countries.

Ownership rights to land and building in Japan by a foreigner is also permitted just like Japanese citizens.

When a registrar has made a registration of ownership with respect to a real property with Legal Affairs Bureau, he/she shall can officially claim the title deeds of the property. However, there are restrictions on agricultural land (farmland). You need to get prior permission from a local agriculture committee (nogyo-iinkai) or governor when you buy the farmland. At least one corporate manager (one member of new owner) has to engage in full-time farming. In other words, if you want to buy farmland, you must become a farmer. The

agricultural commission is to collect, organize, analyze, and provide information on cropland, including the possession and usage status of cropland and trends in rent, etc. thereof in order to contribute to promoting the agricultural use of cropland and managing relations over cropland use as well as to appropriately fulfilling the functions under its jurisdiction.

To improve this situation and to accelerate liquidity in the market for farmland, the government also will likely consider reviewing related issues such as the Agricultural Land Law and local agricultural committees, as well as easing relevant regulations.

Foreigners are able to purchase real estate in Japan just like Japanese citizens. Regardless of foreigners who do not have the permanent residency in Japan, regardless of the type of visa, you can buy Japanese real estate. On the other hand, taxes such as acquisition tax and property tax are payable just like Japanese wherever you live.

However, even if you purchase real estate here, you will not automatically be granted Japanese permanent residency/green card, nor will the type of visa change. You can still leverage your investment to apply for your green card but your investment is a merely tool not requirement/norm.

Standard flow of purchase is as follows :

1.First step

The flow of foreigners buying real estate in Japan is almost the same as Japanese.

First of all, you will make your decision which real estate to purchase by reviewing some properties you like.

When you buy any property, it is critical that you research and collect as much information as possible. The location, price, floor plan, access to public transportation,

is most necessary to identify the best property to meet your needs.

How to find such information ?

You can find advertisements in newspapers, magazines, flyers, inserts, and internet web sites. Internet web sites list many properties but paper media still could be a good choice.

However, the most important thing in gathering property information is to find a reliable real estate agent who can provide updated and credible information.

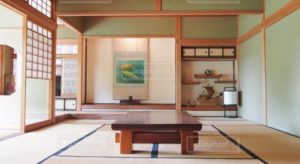

Site viewing

After studying the property information and having found a property that you may want to buy, the next step is to visit and view the property.

Some brave investors do not review the property before they buy it but I certainly don’t recommend the strategy.

Please ask your agent (buyers agent) to accompany you and provide you with detailed on-site information.

Seeing the property is the most effective way to do the due diligence and check the actual conditions and neighboring environment of the property.

Listing information (leaflet) does not necessarily cover all the information.

Property Inspection

When viewing a property, compare closely what is shown and described in leaflet with what you actually see.

Carefully check for stains and other physical aspects that may pose problems in such conditions as exposure to the sun, natural ventilation.One of the signs you want to check is

how the cleaning is done by the management company.If you see a lot of liters on the floor and hall way, the management company could be sloppy.

In addition, it is important that you view the property from the standpoint of other family member.

Area Observation

It is very important that you check out the surrounding environment. Make sure you check the distance to the closest station from the property. Also, confirm availability of public facilities such as schools, parks, hospitals and shopping streets. Please pay attention to the traffic conditions of the area.

The traffic condition could show a different pattern on weekdays from weekends so if you have time, please visit the site both on weekdays and weekend.

Once you pick the best candidate for you, then, you usually sign a commission agency agreement (媒介契約書、baikai-keiyakusho) or broker agreement with the real estate company.

(You can enter the agreement even before you start looking if you wish)

A commission agency agreement is a contract to buy real estate through its real estate company. It shows brokerage services performed by real estate companies, agency commissions payable at the time of sale.

If you don’t want to use an agent, you can directly go to a seller (owner) but we don’t recommend that option.

If you work with a real estate agent(realtor) to buy your property, you will have to pay a brokerage commission of 3% of the purchase price plus 60,000 yen plus tax (now 8%). All realtors must be licensed by the government so please make sure your agent is officially licensed before you enter the contract.

Even soliciting/marketing a property without the official license is illegal in Japan.

2. Second step

Once you have a commission agreement with a real estate agent,

you need to inform your agent how to pay for the real estate.

For most of Japanese, it is common to use mortgage loans. You can apply directly by going to a bank but you can apply through your real estate agent as well (many of agents have connections with a few banks)

However, if you are a foreigner, only those who have acquired permanent residence can get a home loan.

(As of now, there are, however, two Japanese banks who could provide a mortgage loan for non-residence but the conditions are quite stringent and the application is reviewed by case by case basis. For details, please ask us). In case of home mortgage loan, mortgage banks in Japan provide financing to individuals who allocate no more than 25%-30% of their annual income to mortgage loan payments. For investment loan, the different rule is applied so please ask us if you want to know details)

Making an Offer to Sign a Contract

Once you find a property that you wish to purchase, your next step is to make a purchase proposal.

you need to complete application to purchase (買い付け証明書) or

letter of intent(購入申込書) and submit it to your agent.

Application to purchase is normally used in the transaction of newly built properties and letter of intent is for the pre-owned properties. But the purpose is the same. If you are buying a pre-owned residence, you are asked to submit a letter of intent to the seller via your buying agent. The reason to submit a letter of intent is to inform the seller that you are serious about the property. Your seller will not consider you as a potential buyer until you submit a letter of intent. Your agent then will negotiate with the seller on your behalf regarding the purchase price, payment method and timing, delivery date, and staffs that shall remain with the property.

After both parties agree on all issues, your agent will explain any relevant law and other issues related to the transfer of title.Sellers often are not willing to share the detailed information about the property until you submit a letter of intent. However, once your seller receives your letter of intent then your seller is obliged to start the official negotiation with you. Thus real purpose of the letter is to show your serious intent and serve the beginning point for your negotiations. The letter of intent is treated as first come, first served basis.

3. Third step

After your agent negotiates with the seller regarding all the terms and conditions, the method of payment should be decided and the provisional application of the mortgage loan should be made.

If the provisional application is approved by the mortgage bank, the next step will be securing your property by depositing some money, called ‘tetsuke-kin’ (手付け金,earnest money, deposit)

And it is necessary to pay a part of the real estate as deposit. Also, in addition you are asked to pay a part of brokerage commission to your real estate agent.

Even those who are planning to pay everything with mortgage without a down payment, you have to pay the tetsuke-kin (deposit) in cash. Basically any amount can be used for the deposit, standard amount of deposit is between 1%-10% depending on the value of the property. As for brokerage fee, it is common to pay 50% at the time of tetsuke-kin payment.

4. Last step

Finally it is time to finalize the sales contract. Before you finalize the contract, your agent must explain all the

important matters regarding the property and transaction in writing.

The process is called ‘Explanation of “Important Matters regarding the Property and Transaction” (重要事項説明書’)

In accordance with the “Disclosure Statement of Important Matters regarding the Property and Transaction”, a licensed and certified broker shall explain to the buyer details about the property such as title registration, the type of property ownership and right, legal description of the property, payment methods, and the applicable provisions in case of cancellation.

You should understand each clause of the Disclosure Statement and ask your agent for any clarification.

Signing the Purchase and Sale Agreement

If you are happy with the explanation of “Important Matters regarding the Property and Transaction” the final final step is for the seller and buyer to sign the Real Estate Purchase and Sale Agreement (不動産売買契約書) The purpose of this agreement is to stipulate the conditions of the transaction and the rights and obligations of both the seller and buyer to ensure a safe and legally binding transaction. Once parties sign the agreement and the buyer makes a down payment, the agreement comes legally into effect. From that point on, the transaction will be conducted in accordance with the provisions set forth in the agreement. Both parties are obligated to carry out the contractual obligations stipulated in the Agreement. If either party fails to fulfill their contractual obligations, a penalty may be imposed on the breaching party. Therefore, it is strongly recommended that both parties clearly understand each and every provision before signing the agreement to avoid default and payment of any penalties.

Real estate purchase and sale contract is a formal contract to serve the transfer of real estate rights from seller to buyer, you have to clearly understand all terms and conditions in the contract.

Purchasing Costs

When you are purchasing a property, you will need to budget for “transaction costs” such as taxes, brokerage commission and fees in addition to the actual property price.

The total amount of these expenses equals roughly 6-10% of the property price.

Required Documents

These are the typical documents when you enter the Real Estate Purchase and Sale Agreement

Passport

Certificate of Signature or Registered personal seal (inkan, 印鑑, Dated within the past three months)

Down payment

Funds to cover the Stamp Duty fee

50% of the brokerage commission and, separately, general sales tax and regional sales tax.

If you do not live in Japan, you can not obtain registration of the certificate of signature but as an alternative document, “affidavit” “sign certificate” created at the embassy in Japan. However, depending on the country, there are countries that can not be created at the embassy, so please check about ‘sign certificate’ in advance.

Also, as a document that can confirm the address, it is acceptable to use a residence card, but if you do not live in Japan, prepare “affidavit“. Also, when purchasing under the name of a corporation, a corporate registration certificate is necessary.

Besides this, in the case of an agent acting on behalf of a foreigner who does not understand Japanese, or in the case where the agent does not visit Japan, the proxy letter and the proof of identity , signature certificate are also required.

Summary of finalizing the transaction flow

Verification of the contents of the registration forms

↓

Payment of the outstanding balance

↓

Payment of property tax and other fees

↓

Other Payments (e.g. outstanding balance on brokerage commission or other service fees)

↓

Receipt of documents (e.g. warranties, confirmation of property lines, bylaws of the homeowner’association)

↓

Delivery of keys

Required documents and fees at the final payment

To close a purchase and sale transaction, you will need the following at the time of the final payment. Depending on the type of property that you have purchased, specific documents and fees are required. The following shows a list of fees and documents required for residential property purchases.

Passport

Outstanding balance due on the purchase price of the property

Outstanding balance of the brokerage commission

Registration fee (Property Registration & License Tax, handling service fee charged by a judicial scrivener)

Property Tax, City and Planning Tax, Home owners’ Association / Property Management fees and other charges.

Certificate of Signature or Registered personal seal (Dated within the past three months) which required only when a mortgage lien is recorded on the property title.

Ownership title registration procedures (登記手続き)

The property title must be registered to hold a public record of the property ownership. Due to the complexities of the process, it is typically advisable to hire a specialist called ‘judicial scriveners'(shiho-shoshi, 司法書士) to handle this matter for you.

The judicial scriveners (shiho-shoshi, 司法書士)will complete the necessary registration application documents to be filed with the Legal Affairs Bureau (homu-kyoku, 法務局)Upon receiving filed and recorded property title registration documents (Property Title Deed) from your judicial scrivener, you should keep them in a secure place. These application, changing of ownership process shall take only one day and the title of the property is transferred to you on the same day of your final payment. Once your property is registered with Legal Affairs Bureau, your title right is guaranteed by the Japanese government whether you reside in Japan or not.

Other Helpful Articles

Japan market update. How are big players betting ? : Is it in the state of bubble ?

Buying a house in Japan ? Here’s all-too common mistakes to avoid

Toshihiko Yamamoto

Real estate investing consultant and author.

Founder of Yamamoto Property Advisory in Tokyo.

International property Investment consultant and licensed

real estate broker (Japan).

He serves the foreign companies and individuals to buy and sell

the real estates in Japan as well as own homes.

He holds a Bachelor’s degree in Economics from

Osaka Prefecture University in Japan

and an MBA from Bond University in Australia

Toshihiko’s book, “The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage and Sell Real Estate in Japan”is now out on Amazon, iBooks (iTunes, Apple) and Google Play.

About the book

Amazon.com Link

3 comments for “Can foreigners buy a property in Japan ? : Fundamental rules when acquiring a property”