Tokyo’s Ultra-Luxury Residential Market in 2025: Rising Demand, Limited Supply, and Future Outlook

Introduction

Tokyo’s ultra-luxury residential market has quietly emerged as a major global player. In 2025, the city is increasingly drawing the attention of ultra-high-net-worth individuals (UHNWIs) worldwide. A confluence of limited supply, strong demand, economic stability, and cultural prestige is reshaping Tokyo into a preferred destination for wealth preservation and lifestyle investment.

Current State of Tokyo’s Ultra-Luxury Residential Market

Definition and Price Benchmarks Ultra-luxury residences in Tokyo typically start from JPY 1 billion and command prices of over JPY 30 million per square meter. Properties such as Aman Residences, Toranomon Hills, and MARQ Omotesando ONE exemplify this prime residential market, with record-breaking sales and rising benchmarks.

Characteristics of Ultra-Luxury Properties Located in Aoyama, Azabu, and Roppongi, these residences offer unmatched security, concierge services, privacy, and architectural excellence.

Screenshot

Factors Driving Price Increases

- Limited new supply since 2023.

- Scarcity of suitable land for new development.

- Rising construction costs in Tokyo.

- Weakened yen boosting foreign buyer activity.

Screenshot

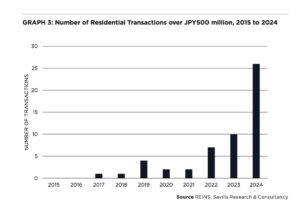

Transaction Trends and Market Liquidity

Historic Highs in 2024 In 2024, Tokyo recorded 28 residential transactions above JPY 500 million — a historic volume showcasing the market’s growing liquidity and high-end property investment opportunities.

Recent Sales and Current Asking Prices

Recent Resales

- MARQ Omotesando ONE: JPY 32.8M/sq.m.

- Toranomon Hills: JPY 29.1M/sq.m.

- Parkhouse Chidorigafuchi: JPY 36.6M/sq.m.

Current Listings

- Roppongi Hill Top: JPY 47.4M/sq.m.

- Akasaka Hinokicho: JPY 44.9M/sq.m.

- Mita Garden Hills: JPY 41.2M/sq.m.

The Role of Inbound Tourism

Inbound tourism has become a powerful market driver. In 2024, Japan welcomed 37 million visitors, with many affluent tourists increasingly converting into luxury property buyers. Spending patterns indicate high-end tourists contribute significantly to Tokyo’s ultra-luxury residential sector.

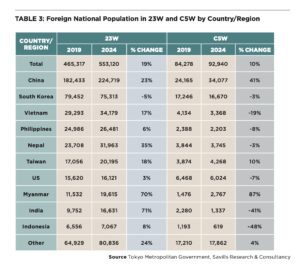

Demand Profile: Who Is Buying?

- Domestic UHNWIs: 16,500 across Japan, 6,500 in Tokyo.

- International Buyers: Growing numbers from Hong Kong, Singapore, and Mainland China.

Many buyers aim for long-term ownership and legacy planning, making Tokyo real estate investment increasingly attractive.

Screenshot

Why Tokyo Remains Attractive

- Exceptional safety and stability

- Transparent legal system

- Global cultural prestige

- High-quality education and healthcare

Tokyo stands out as a secure and culturally rich destination for UHNWIs seeking real estate assets with lasting value.

Supply Outlook Toward 2030

- No major ultra-luxury completions before 2030.

- Severe land scarcity and regulatory challenges will continue to limit supply, reinforcing the appeal of Tokyo’s prime residential assets.

Future Price Projections

- Expectations for JPY 50M–60M per sq.m. by 2030.

- Tokyo is poised to join global peers like London’s Mayfair, New York’s Billionaire’s Row, and Hong Kong’s The Peak in pricing.

Investment Implications for UHNWIs

Ultra-luxury Tokyo real estate offers:

- Inflation resilience

- Legacy wealth preservation

- Safe-haven diversification

Investing now allows early positioning in a tightening market.

How Yamamoto Property Advisory Can Help

Yamamoto Property Advisory specializes in:

- Discreet access to Tokyo’s finest off-market properties (See Our Services)

- Bilingual transaction support

- Strategic acquisition advisory for UHNWIs

Explore our latest luxury listings and learn how we assist global investors in navigating the Tokyo real estate market.

Conclusion

Tokyo’s ultra-luxury residential sector is transitioning into a new global asset class. For discerning investors seeking safety, prestige, and long-term value, Tokyo presents a compelling opportunity.

We invite you to connect with us at Yamamoto Property Advisory for personalized consultation and investment opportunities.

Savill report

https://jp.savills.co.jp/research_articles/167674/221042-0

Toshihiko Yamamoto is the founder and principal broker of Yamamoto Property Advisory,

a distinguished real estate brokerage in Tokyo that specializes in luxury residential and investment properties for an international clientele.

His firm caters to discerning investors seeking premier properties for personal use and income-generating whole buildings for investment purposes.

A licensed realestate broker in Japan, Mr. Yamamotoholds an MBA from Bond University in Australia

and a Certified Commercial Investment Member (CCIM) designation from the CCIM Institute in the United States.

His extensive international experience, having lived abroad in Australia and the United Kingdom, equips him

with a nuanced understanding of global real estate trends and the unique needs of foreign investors.

With over two decades of experience in international business, Mr. Yamamoto has successfully conducted business with clients from more than 20 countries.

As a seasoned property investor himself, he provides informed guidance to his clients as they navigate the intricacies

of the Japanese real estate market to secure optimal investments.

Discover more in his book, “The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage,

and Sell Real Estate in Japan,” available on Amazon, iBooks, and Google Play.

Connect with us through social media on Instagram, WhatsApp, and LINE for further information and expert assistance.

About the book

Amazon.com Link