Let’s face it.

Kenbiya (One of Japan’s major internet web sites on the real estate property for the investment) recently announced the latest market update

for the first quarter of 2019. I am quickly sharing the summary of the report today.

Price: The average asking price

Yield :Gross yield. It is calculated as a percentage based on the property’s market value divided by the income generated by the property

(before finance cost/management cost/tax)

Overall Japan

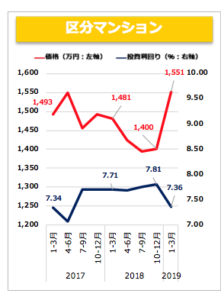

Condominiums (one unit)

January-March 2019

Yield 7.36% (-0.45 points compared to the previous quarter)

Ave Price 15.51 million yen (+ 10.79 point )

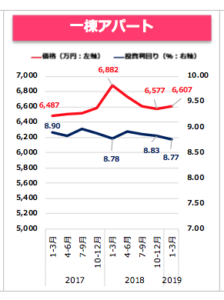

Apartment building (Wooden)

Yield 8.77% (-0.06 points)

Ave Price 66.07 million yen (+ 0.46 points)

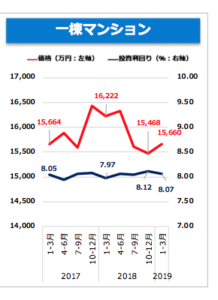

Apartment building (Steel and RC)

Yield 8.07% (-0.05 points)

Ave Price 156.6 million yen (+ 1.24 points)

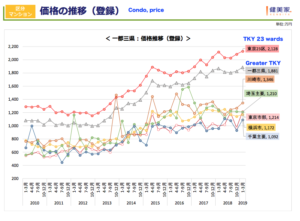

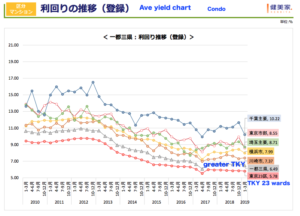

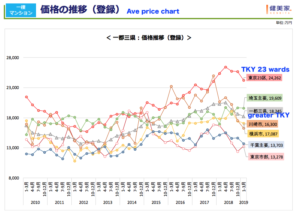

Greater Tokyo (Tokyo, Kanagawa, Saitama, Chiba)

Condominiums

-October-December 2018

Yield 7.73% Ave Price 18.17 million yen

-January-March 2019

Yield 6.54% Ave Price 18.74 million yen

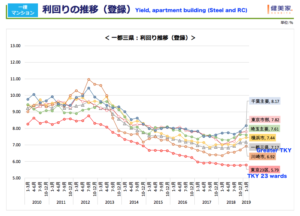

(Price chart)

(Yield chart)

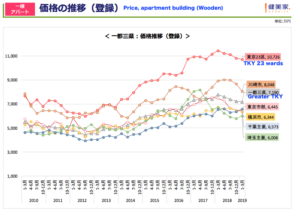

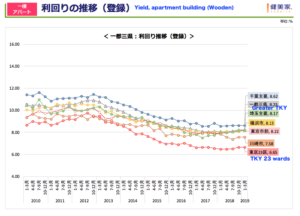

Apartment building (Wooden)

-October-December 2018

Yield 8.39% Ave Price 70.82 million yen

-January-March 2019

Yield 8.39% Ave Price yen 70.55 million yen

(Price chart)

(Yield chart)

Apartment building (Steel and RC)

-October-December 2018

Yield 7.31% Ave Price 183.81 million yen

-January-March 2019

Yield 7.34% Ave Price 180.3 million yen

(Price chart)

(Yield chart)

Tokyo 23 wards (meaning central Tokyo) * please also see the charts above.

Condominiums

-October-December 2018

Yield 5.83% Ave Price 20.85 million yen

-January-March 2019

Yield 5.78% Ave Price 21.28 million yen

Apartment building (Wooden)

-October-December 2018

Yield 6.63% Ave Price 108.15 million yen

-January-March 2019

Yield 6.65% Ave Price 107.26 million yen

Apartment building (Steel and RC)

-October-December 2018

Yield 5.76% Ave Price 256.97 million yen

-January-March 2019

Yield 5.79% Ave Price 242.62 million yen

Final Thought

As you can see by the charts, all segments of the real estate investment (between 20 mill yen to 200 million yen) are

clearly showing the moderate softening. The price of residential building has been down for three consecutive months.

I believe that while investor appetite remains strong, both investors and lenders are likely to become more cautious on the back of rising real estate prices.

Amid the continued low interest rate environment, Japan remains an attractive market for foreign investors due to the relatively high spreads.

I am continuing to see good activities from Chinese and American investors as well as Japanese investors.

In the meantime, lending policies by almost all Japanese banks have tightened over the course of last several months.

The tightening is hampering this particular market segment.

However, If you look at the office properties segment, probably you can see a different scenario.

According to Miki shoji (office property specialist), the average vacancy rate as of March in Tokyo Business District (Tokyo 5 wards / Chiyoda / Central / Port / Shinjuku / Shibuya-ku)

is as low as 1.78%.

The average rent for the Tokyo Business District as of March is 21,134 yen per tsubo (3.3 m2).

It increased by 7.28% (1,435 yen) compared with the same month last year, 0.16% (33 yen) compared with the previous month, and rose for 63 consecutive months.

Over all, the segment for the small to mediums size investors looks to be near to the end of the market cycle.

As far as BOJ keeps the interest low, there is always good appetite from the investors.I don’t think the market will collapse.

If you have enough cash for the down-payment, you can find pretty good deals now.

Source:

Other Helpful Articles

Long-lasting growth ? Market update : Japan land price 2019 -first time rise in 27 years-

Expect home sales to continue on a downward trend ? : Japan real estate market recap 2018

Toshihiko Yamamoto

Real estate investing consultant and author.

Founder of Yamamoto Property Advisory in Tokyo.

International property Investment consultant and licensed

real estate broker (Japan).

He serves the foreign companies and individuals to buy and sell

the real estates in Japan as well as own homes.

He holds a Bachelor’s degree in Economics from

Osaka Prefecture University in Japan

and an MBA from Bond University in Australia

Toshihiko’s book, “The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage and

Sell Real Estate in Japan”is now out on Amazon, iBooks (iTunes, Apple) and Google Play.

About the book

Amazon.com Link

(Can foreigners buy a property in Japan ?)