Reviving Japan’s Countryside:

How Foreign Investors are Transforming Vacant Houses

into Opportunities

Are you an overseas investor or foreign national intrigued by the charm and allure of traditional Japanese homes?

If so, there is an exciting opportunity waiting for you.

As the appreciation for traditional Japanese architecture grows,

a promising trend is emerging that not only provides a unique investment opportunity

but also contributes to solving a significant societal issue in Japan – vacant houses.

Foreign buyers are increasingly attracted to these vacant, traditionally styled homes,

often located in the heart of Japan’s beautiful countryside.

Fueled by the rich cultural heritage encapsulated in these properties and a relatively lower cost

due to the weaker yen, this trend provides an opportunity for foreign investors to own a slice of authentic Japanese culture.

Take, for instance, Lee Shenje from Singapore. He purchased and restored a 110-year-old house

in Ryujin Village, Tanabe City, Wakayama Prefecture, and operates a local diner,

further integrating himself into the local community.

Cases like these are increasingly common as more

and more foreigners appreciate the unique aesthetic these traditional houses offer.

However, the rise in foreign buyers alone will not completely resolve the issue of vacant houses.

It’s essential to create an environment that fosters mutual understanding and appreciation of cultural differences and values.

The Japanese government has implemented measures to address this issue,

allowing local governments to instruct owners of vacant houses to make necessary repairs or removals.

These measures, coupled with foreign investment, can rejuvenate these vacant properties,

turning them into valuable assets rather than burdens.

Are you ready to embark on an investment journey that not only provides a lucrative return

but also allows you to contribute positively to Japanese society?

As a Tokyo-based real estate agent specializing in assisting foreign nationals,

I can provide you with the necessary guidance and support.

Don’t miss out on this unique opportunity to invest in Japan’s rich cultural heritage and

vibrant real estate market. Contact me today, and let’s explore the exciting prospects

that lie ahead in the world of traditional Japanese homes.”

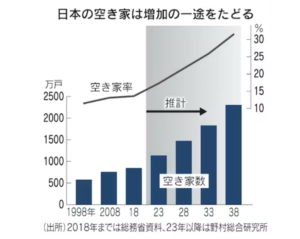

*Number of akiya (vacant house or unused house)

from Nikkei

Source: Nikkei

Insight

While foreign investors’ growing interest in traditional Japanese homes presents a unique opportunity

to address the country’s vacant housing problem, it’s crucial to consider the challenges that come with such investments.

These homes, often steeped in cultural heritage and located in picturesque rural settings, offer an immersive experience of authentic Japanese culture.

However, the process of transforming these properties into livable or commercially viable spaces can be complex and costly.

One of the significant challenges is the cost of renovation.

These traditional homes, often vacant for extended periods, may require substantial repair and renovation work.

I wanted to bring to your attention that Akiya homes in Japan are often in a state of disrepair

and may require significant renovation work to make them livable,

which can cost up to 10-20 million yen.

Additionally, these older buildings typically lack modern insulation, making them less energy-efficient

and potentially uncomfortable during Japan’s harsh winters or hot summers.

Retrofitting them with modern insulation can be a substantial part of the renovation costs.

Despite these challenges, foreign investors are increasingly attracted to these properties.

They see potential in these homes as they offer a unique aesthetic and cultural value not found in modern architecture.

However, the decision to invest should be made with a clear understanding of the potential costs

and challenges involved in renovating and maintaining these traditional houses.

The government’s legislation that allows local authorities to instruct owners of vacant houses

to make necessary repairs or removals can help address some of these challenges.

However, investors need comprehensive support and guidance to navigate the renovation process

and understand the potential costs and practical implications of owning and maintaining a traditional Japanese home.

The trend of foreign investment in traditional Japanese homes represents a potentially promising,

albeit challenging, opportunity in the real estate market.

While it offers an innovative approach to addressing Japan’s vacant house issue,

it requires careful consideration and planning. It underscores the need for foreign investors to work closely

with knowledgeable real estate agents who understand both the cultural significance and

practical challenges of owning these unique properties.

Are you a foreign investor captivated by the allure of traditional Japanese homes?

As a seasoned real estate agent in Tokyo,

I can guide you through the intricacies of investing in these unique properties.

With a deep understanding of their cultural significance and the practical challenges involved,

I will help you navigate the renovation process and make informed decisions.

Let’s unlock the potential of traditional Japanese homes together.

Contact us today to embark on this promising, yet challenging, real estate opportunity.

Toshihiko Yamamoto

Real estate investing consultant and author.

Founder of Yamamoto Property Advisory in Tokyo.

International property Investment consultant and licensed

real estate broker (Japan).

He serves the foreign companies and individuals to buy and sell

the real estates in Japan as well as own homes.

He holds a Bachelor’s degree in Economics from

Osaka Prefecture University in Japan

and an MBA from Bond University in Australia

Toshihiko’s book, “The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage and Sell Real Estate in Japan” is now out on Amazon, iBooks (iTunes, Apple) and Google Play.

About the book

Amazon.com Link