(Refined architecture meets enduring value — front view of a 498 sqm residence in Shoto.)

A Rare Opportunity in Shoto, Shibuya — Refined Living and Resilient Value in Tokyo’s Premier Residential District

Located in the heart of Shoto 1-chome — a neighborhood long revered as the pinnacle of luxury living in Tokyo — this exceptional residence offers not only architectural presence and privacy, but also rare long-term investment stability.

Just a few minutes from the energy of Shibuya, Shoto has quietly retained its status as Tokyo’s most exclusive low-rise residential enclave. It is home to embassies, private schools, cultural institutions, and elegant tree-lined streets — protected by strict zoning that limits density and preserves its refined character. This balance of serenity and accessibility makes it a perennial favorite among executives, artists, and international families alike.

Investment Perspective

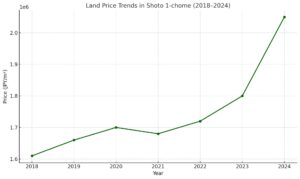

Over the past decade, Shoto has proven to be one of Tokyo’s most stable and high-performing real estate markets. Land values in both Shoto 1-chome and 2-chome have risen significantly:

-

Shoto 1-chome: From ¥1,610,000/sqm in 2018 to ¥2,050,000/sqm in 2024

(Approx. +27.3% over six years) -

Shoto 2-chome: From ¥1,210,000/sqm in 2016 to ¥1,590

-

,000/sqm in 2024

(Approx. +31.4% over eight years)

In fact, Shoto 2-chome saw a 10.1% price increase in just the past year — a remarkable gain even by global luxury market standards such as New York or London.

[Figure 1: Land Price Trends in Shoto 1-chome (2018–2024)]

Land value increased by 27.3% over six years, with a sharp acceleration in 2024.

[Figure 2: Land Price Trends in Shoto 2-chome (2016–2024)]

Prices rose 31.4% over eight years — including a 10.1% increase in just the last year.

In addition, condominium prices across Shibuya Ward have surged by 83.2% over the past nine years, and Shoto-specific condos have seen an 80.6% rise. This long-term appreciation reflects both high demand and low inventory — a signature of stable prime property markets.

As of 2024, average market rates in Shoto are approximately:

-

Land: ¥1,729,000/m²

-

Condominiums: ¥1,476,000–¥1,533,000/m² (for 70 m² units)

-

Rental Market: ¥5,200–¥5,772/m²

Property Overview

(Minimalist in design, maximal in comfort — a living room designed for refined urban living in the heart of Tokyo.)

Set on a generous 330.58 m² (approx. 100 tsubo) parcel of elevated, flat land, this residence is built with reinforced concrete across four levels — three above ground and one basement — with a total floor area of 498.39 m² (approx. 150.76 tsubo).

Its 13.83-meter frontage on a 5.4-meter-wide public road ensures ease of access while maintaining discretion and privacy.

(A curated selection of low-rise residences in Shoto — each reflecting the neighborhood’s enduring elegance, architectural restraint, and commitment to privacy.)

Key Features

-

5 Bedrooms

-

4 Service Rooms

-

3 Walk-In Closets

-

4.5 Bathrooms

-

Parking for 2 vehicles (shutter gate, compatible with high-roof vehicles*)

-

Freehold ownership

-

Built in January 2000

-

Located in a Category 1 Low-Rise Exclusive Residential Zone (10m height restriction)

-

Just a 7-minute walk to Shinsen Station (Keio Inokashira Line)

-

Quiet, secure, and low-density residential environment

Price and Availability

Asking Price: ¥2.2 Billion (approx. USD 14.7 Million)

Occupancy Status: Owner-occupied (vacant possession negotiable)

Learn More

If you are seeking long-term capital preservation in Tokyo’s most prestigious neighborhood, this residence represents a rare opportunity. For further information or to arrange a private viewing, please contact us or visit our website:

#

#

#TokyoLuxuryRealEstate

#ShotoPropertyMarket

#ShibuyaHighEndHomes

#InvestmentInTokyo

#ExclusiveTokyoResidences

#FreeholdPropertyJapan

#TokyoRealEstateTrends

#JapanLuxuryInvestment

#Shoto1Chome

#TokyoAssetGrowth

Toshihiko Yamamoto – Founder and Lead Broker, Yamamoto Property Advisory

Toshihiko Yamamoto is the founder and principal broker of Yamamoto Property Advisory,

a distinguished real estate brokerage in Tokyo that specializes in luxury residential and investment properties for an international clientele.

His firm caters to discerning investors seeking premier properties for personal use and income-generating whole buildings for investment purposes.

A licensed realestate broker in Japan, Mr. Yamamotoholds an MBA from Bond University in Australia

and a Certified Commercial Investment Member (CCIM) designation from the CCIM Institute in the United States.

His extensive international experience, having lived abroad in Australia and the United Kingdom, equips him

with a nuanced understanding of global real estate trends and the unique needs of foreign investors.

With over two decades of experience in international business, Mr. Yamamoto has successfully conducted business with clients from more than 20 countries.

As a seasoned property investor himself, he provides informed guidance to his clients as they navigate the intricacies

of the Japanese real estate market to secure optimal investments.

Discover more in his book, “The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage,

and Sell Real Estate in Japan,” available on Amazon, iBooks, and Google Play.

Connect with us through social media on Instagram, WhatsApp, and LINE for further information and expert assistance.

About the book

Amazon.com Link