Cleanup, rescue operations underway in Japan after severe rains kill over 200 people and strand thousands in the recent flooding and landslides in west Japan.

On Mar 11, 2011, a devastating 9.0-magnitude quake struck under the Pacific Ocean, and the resulting tsunami caused widespread damage and claimed tens of thousands of lives.

It also sent three reactors into meltdown at the Fukushima nuclear plant, causing Japan’s worst postwar disaster and the most serious nuclear accident since Chernobyl in 1986.

The devastating tsunami hit sites along the Tohoku coast.

A public beach just opened in Rikuzentakata on July 20, 2018 for the first time in eight years, underscoring the destruction of sites.

In 1703, an 8.2 magnitude earthquake(Genroku earthquake) along the Sagami Trough triggered a tsunami that rippled towards Japan’s then capital, Edo. It is estimated that a couple of thousands lives were lost.

Japan has a lot of natural disasters and many foreign investors are worrying about it.

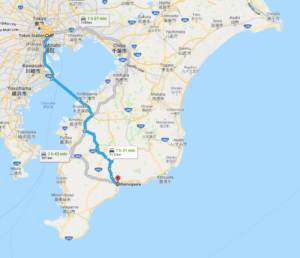

A major earthquake is expected to strike sometime along the Nankai Trough, a submarine trench running off the Japanese archipelago from around Shizuoka Prefecture in Honshu to the seas east of Kyushu.

How at risk is Tokyo Bay from future tsunami by Nankai Trough earthquake ?

The Nankai Trough is a 700-kilometer-long sea-bottom depression that runs about 100 km off the southern coast from Shizuoka Prefecture to the Shikoku region.