Terrifying hidden crisis or treasures ?

In Japan, recycling is so much part of our culture.

And yet, it is also the norm for Japanese to demolish their houses with almost less thought than most people would give to disposing beloved ceramic bowls.

People believe homes are usually built to last 50 odd years. Japanese building culture is often described as ‘scrap and build’.

The reasons for this phenomenon range from the ageing to need for constantly updating building technology as it revolves.

With shrinking population, the result is a housing problem that is the opposite of what most countries face. Japan has too many houses that no one wants.

According to the government statistics, the number of vacant houses (空き家、akiya) in 2013 reached 8.2 million.

(But the 8.2 million includes houses/apartment units for rent that are only vacant temporarily as owners try to find tenants or buyers. So genuine empty homes that have been abandoned altogether number about 3 million)

Moreover, many who inherit a house are unable to sell them because of a shortage of interested buyers. The problem is particularly acute in rural areas.

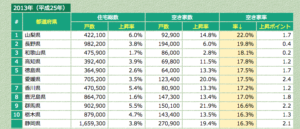

According to one statistics, the top ten ranking of akiya in prefectures as of 2013 was as follows.

(The number indicates the percentage of akiya in dwellings of each prefecture)

In these prefectures, 1 out 5 properties are empty.

1.Yamanashi 22%

2.Nanago 19.8%

3.Wakayama 18.1%

4.Kochi 17.8%

5.Tokushima 17.5%

5. Ehime 17.5%

7. Kagawa 17.2%

8. Kagoshima 17.0%

9.Gunma 16.6%

10.Tochigi 16.3%

10. Shizuoka 16.3%

(top10 ranking)