What is the purpose of the mission of the Building Standards Law?

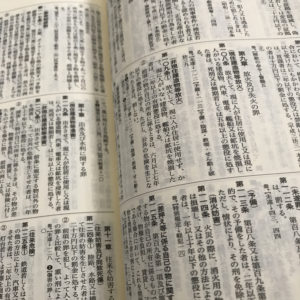

The Building Standards Law (建築基準法)was created for the MLIT to provide basic rules for construction during a building and the stipulates minimum engineering safety requirements concerning fire earthquake and other natural disasters.

It also stipulates the types of buildings we can build according to each zoning district(用途地域)

under the city planning law.

A building not contracted to meet this requirement is regarded as an illegal building however a building previously constructed in compliance with a standard existing at the time of the construction but which no longer meet current construction standards is not considered as an illegal building but rather called non-conforming building. (既存不適格)

*

When you find the cheap property, please make sure if it is a non-conforming building or not. It is not a fatal mistake to buy such a property, but you have to understand what you are running into beforehand.