Introduction

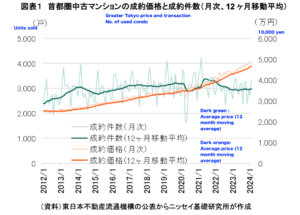

*Greater Tokyo transaction price and transaction numbers

(From NLI chart)

As a leading expert with 15 years of experience as a residential property investor and landlord in Tokyo’s real estate market,

Yamamoto Property Advisory offers unparalleled insights and tailored investment strategies

for foreign investors looking to navigate this dynamic landscape.

Our deep understanding from a landlord’s perspective enriches our advisory services,

ensuring that you receive the most informed and strategic guidance available.

The report from NLI Research Institute, a think tank of Nihon Life insurance group, dated March 22, 2024,

provides an analysis of the used condominium market in the Tokyo metropolitan area (greater Tokyo, including

Tokyo, Kanagawa, Saitama and Chiba)with a focus on the effects of financial policy changes

and market dynamics.

The used condominium market in the Tokyo metropolitan area has a significant impact on the overall real estate market in Japan

due to its large scale and influence,and because Tokyo is the center of economic activity in Japan. For this reason,

this market is considered an indicator of the entire Japanese real estate market.

Here’s a concise summary of the main points of the report.

Market Trends:

There has been a noticeable increase in the closing prices for used condominiums,

which as of February 2024 stood at ¥48.59 million,

marking an 11.5% rise from the previous year.

Transaction numbers have seen a modest increase, suggesting a market that is relatively stagnant

in terms of sales volume.

Price Discrepancies:

A gap is evident between the selling prices and the inventory prices, with inventory prices showing a slight decline,

indicating that properties not sold within the sales period might see price reductions by sellers becoming less optimistic.

Segmented Performance:

Lower-priced units (below ¥30 million) show a consistent decrease in transaction rates,

suggesting these are less competitive due to factors like location and age.

Mid-priced units (¥30 million to under ¥50 million) generally perform better,

but there’s a trend towards decreasing transaction rates.

Higher-priced units (¥50 million to under ¥100 million) maintain higher transaction rates,

indicative of their high asset value and appeal to genuine buyers.

The most expensive units (over ¥100 million) have lower liquidity and take longer to sell,

though they serve as a strong hedge against inflation.

Inventory Levels:

Inventory has reached a post-financial crisis high, suggesting a slowdown in the market.

This includes a significant increase in unsold new detached houses and used houses,

reflecting broader market challenges.

Economic Impact: Recent policy changes by the Bank of Japan, like the cessation of negative interest rates and rate hikes,

are expected to have limited, yet tangible impacts on the real estate market,particularly influencing the segments

where demand has been weakening.

Market Outlook:

The current market dynamics indicate that while premium properties continue to sell,

the overall environment is challenging, especially for mid-range priced properties.

Buyers and sellers need to carefully consider renovation costs and property management

to maintain competitiveness and asset value.

Here is a more detailed discussion of the report.

1.Summary of the Tokyo Metropolitan Used Condominium Market

The Tokyo metropolitan area continues to exhibit dynamic shifts in the used condominium market,

characterized by a notable increase in closing prices and a stagnant transaction volume.

According to the latest report, the average closing price for used condominiums in February 2024 was ¥48.59 million,

marking an 11.5% rise from the previous year. This escalation reflects the ongoing trend of price inflation within the region,

influenced by both domestic economic policies and international market conditions.

Transaction volumes, however, tell a slightly different story.

While there has been a modest year-over-year increase of 3.4%, bringing the total to 3,350 transactions for February 2024,

the figures have largely plateaued when viewed against the backdrop of the past few years.

This indicates a market that, despite rising prices, is experiencing a level of demand stagnation.

Such trends are critical for investors to understand as they indicate both the resilience and the challenges

within the Tokyo real estate market, setting the stage for nuanced investment strategies.

2. Implications of Current Market Conditions

The current market conditions in Tokyo’s used condominium sector have been significantly shaped by recent economic policies,

particularly the Bank of Japan’s decision to end negative interest rates and implement its first rate hike in 17 years.

These changes are anticipated to gradually influence property prices, creating a more cost-intensive borrowing environment.

Such economic shifts tend to decrease buyer affordability,

which could cool down the overheated segments of the real estate market.

However, the effects might be nuanced, affecting different segments variably.

Analyzing the market performance across various price segments, distinct trends emerge:

Lower-Priced Segments (Below ¥30 million) have experienced decreased transaction rates,

indicating a lack of competitive edge or appeal to investors due to factors like less desirable locations

or older property conditions.

Mid-Priced Segments (¥30 million to ¥50 million) continue to see healthier transaction activity,

suggesting a balanced appeal to both investors and residential buyers looking for value and quality in accessible locations.

Higher-Priced Segments (¥50 million to ¥100 million) show resilience in maintaining value and demand,

attractive to those seeking premium investments or properties that promise better long-term returns.

Luxury Segments (Over ¥100 million) are witnessing a complex market dynamic, where despite high prices,

liquidity is lower, and sales periods are longer, though they remain a viable hedge against inflation and market volatility.

These trends illustrate how different market segments are reacting to the broader economic climate,

providing valuable insights for investors on where to focus their strategies for optimal returns

in Tokyo’s diverse real estate landscape.

*Transaction price, listing price and price of inventory

3. Insights for Foreign Investors

The Tokyo metropolitan used condominium market offers intriguing opportunities and challenges

for foreign investors, which require nuanced understanding and strategic planning.

Considering the current economic climate and market trends, here are the insights tailored for foreign buyers looking to navigate this sector.

Opportunities:

The market’s robust price growth, particularly in strategically located properties, provides a strong opportunity for capital appreciation.

Foreign investors can benefit from investing in mid to high-range priced segments,

where demand remains relatively stable despite overall market fluctuations.

Additionally, with the Japanese yen’s fluctuations, there might be favorable exchange rate scenarios that could provide additional financial benefits

to foreign investors entering the market.

The luxury segment also offers unique opportunities for those looking to invest in high-value properties

that typically retain their worth even in volatile economic times, acting as a safe asset against inflation.

Potential Risks:

While the market is ripe with opportunities, it also carries risks, primarily due to the potential

for further economic policy shifts such as additional interest rate hikes,

which could affect borrowing costs and reduce overall affordability.

Moreover, the cultural and regulatory landscape in Japan can be complex for foreign investors.

Issues such as property rights, understanding local market nuances,

and navigating legal requirements need careful consideration.

Strategic Considerations:

To mitigate these risks, foreign investors should consider partnering with local experts,

including real estate agents, lawyers, and financial advisors who understand both the market

and the legal framework of property investment in Japan.

It’s crucial to have a clear exit strategy, considering the liquidity of higher-priced properties can be lower,

making them harder to offload in a downturn. Investors should focus on properties in prime locations

that typically experience higher demand, ensuring easier resale or rental opportunities.

Engaging in thorough due diligence and leveraging professional property management services can also protect

and potentially enhance investment value.

Adopting a strategic approach, informed by current market trends and economic policies,

will enable foreign investors to make the most of their ventures into Tokyo’s used condominium market.

Insight:

Invest in Tokyo’s mid to high priced condominiums in Minato/Shibuya/Shinjuku, where demand remains robust due to

continuous urban development and foreign interest.

We recently supported a Russian investor in purchasing a condominium in Tokyo, with which he was thoroughly pleased.

This experience underscores our commitment to delivering exceptional outcomes

for our international clients and demonstrates our expertise in meeting the unique needs of investors from around the world.

At Yamamoto Property Advisory in Tokyo, We Guide You Through Every Aspect of the Japanese Real Estate Market

Whether you’re looking to invest in residential or commercial properties, or seeking a perfect home or business space,

our expert team is equipped to provide you with personalized, strategic guidance.

We specialize in helping foreign investors and buyers navigate the complexities of the Japanese real estate market,

aligning our services with your investment goals and practical needs.

Discover Investment and End-Use Property Opportunities in Tokyo’s Real Estate Market

Explore the dynamic opportunities of Tokyo’s vibrant real estate market with a personalized consultation at Yamamoto Property Advisory.

Our tailored approach ensures that each investment or purchase aligns perfectly with your goals,

maximizing potential returns and satisfaction while effectively managing the risks associated with international and local property transactions.

Get Started on Your Property Journey Today

For expert advice tailored to your unique needs and to learn how we can help you succeed in the Tokyo real estate market,

please contact us directly.

Reach out via email at yamamoto@yamamotoproperty.jp or connect with us on social media platforms like

Instagram, WhatsApp, and LINE for immediate assistance.

Let’s build or find your ideal real estate solution together—contact us today!

Take the first step towards securing your investment or finding your ideal property

in one of the world’s most dynamic real estate markets with Yamamoto Property Advisory.

Toshihiko Yamamoto Real Estate Investment Consultant, Author, and Founder of Yamamoto Property Advisory, Tokyo

Licensed Real Estate Broker (Japan)

Toshihiko specializes in assisting foreign companies and individuals in purchasing, managing, and selling properties in Japan.

He holds a Bachelor’s degree in Economics from Osaka Prefecture University and an MBA from Bond University, Australia.

Discover Toshihiko’s expertise in his book,

“The Savvy Foreign Investor’s Guide to Japanese Properties: How to Expertly Buy, Manage, and Sell Real Estate in Japan,”

available now on Amazon, iBooks, and Google Play.

Please connect with us via social networks including Instagram, WhatsApp, and LINE for more information and assistance.

WA, LINE and INSTAGRAM