Do you want to buy a house or invest in Japan ?

If you’re considering an international investment property, step one is to find a good real estate agent who understands the country’s regulations,

especially if you’re not fluent in the local language.

Next question is what sort of criteria for judgement do you have in your mind for finding a property ?

If you don’t know what you’re looking for, you’ll never find it.

How about crime rate ?

Good.

Japan is safe.

Having lived in Kobe, Kawasaki, Tokyo, Sydney, Gold Coast, London

and travelled over 25 countries, I can assure it. And crime rates are an important indicator to analyze when looking for an investment property.

Buying the property in a high crime country or area can be risky not only to you, but also to your investment or even to your tenants.

High crime generally reduces the values of properties in a given area.

A study in USA for example, found that a 10 percent reduction in homicides resulted in an 0.83 percent increase in housing values the following year.

Needless to say, people in Japan do care about the safety in the neighborhood.

I am not saying that you can’t make money in areas with higher crime.

There could be a good number of investments in areas with a relatively high crime rate. There are still?plenty of good people in those areas that you can make money renting or selling to.

But the important thing is to know what you are getting into.

It is important up front to decide what kind of risk tolerance you have and what types of areas you are willing to invest in.

But how safe is Japan ?

Once you’ve decided on what kind of areas(countries) you are looking to invest in,

you can start to research them. Always ask Google first.

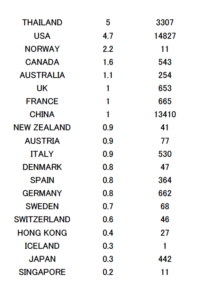

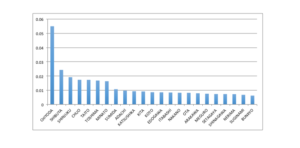

Here is the some statical data on some developed countries by UN, GLOBAL STUDY on HOMICIDE 2013.

I made the abstract data for you.

Intentional homicide count and rate per 100,000 population, by country.

As you can see, ranking with Singapore (that has only 5 million population),

Japan is undisputedly the safest country in the world.

Looking at the rate per 100,000, in a sense, Japan is 2 times safer than Switzerland and 16 times safer than USA.

Considering over 127 million population, Japan’s homicide counts is significantly small at 442 per year.

Japan saw less homicides than UK or Germany or France.

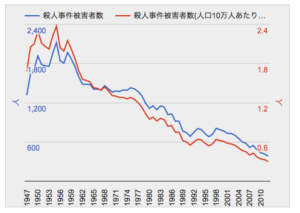

I gathered the historical data on homicides in Japan.

Below is the chart showing the number of homicides in Japan announced by the government.

(data source :nenji tokei)

The blue and red chart indicate the gross number of homicides and homicide rate per 100,000 respectively (all Japan)

Japan has been very safe for a long time.

If you want to invest a lot of money in foreign countries, the security and safety are the very important

factors.

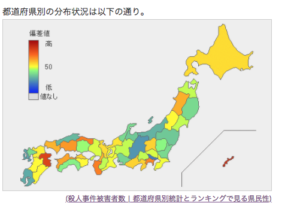

The map below shows the number of homicides in each prefecture.

Red indicates high in homicide numbers and blue indicates less.

What about other crimes ?

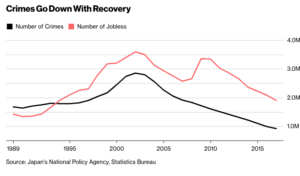

In addition, below is the chart I have taken from Bloomberg.

As you can see, number of crime in general is Japan also has been decreasing in very healthy manner over the years.

Japan is becoming safer and safer every year in every aspect.

Crime rate of Japan by Bloomberg February 2018

I know there are other factors for our daily life such as nuclear power, traffic accidents and air quality so and so forth but that is not the point for this article.

By comparison, according to an article on February 19, in USA today.

QTE

Baltimore is the big city with the highest per capita murder rate in the nation, with nearly 56 murders per 100,000 people. At 343 murders in 2017, the city tallied the highest per capita rate in its history. Columbus tallied 143 murders – 37 more than 2016.

“In New York, they concentrated on the right neighborhoods, they’ve invested well in predictive analytics and technology,” said Peter Scharf,

a criminologist at the LSU School of Public Health and Justice. “The other part of what we’re seeing nationally might be a story of haves and have-nots. While some departments have made the investments, other police departments are still in the backwater of policing.”

UNQTE

Baltimore city alone saw 343 murders in 2017 but that is not my point.

My point is that “In New York, they concentrated on the right neighborhoods”.

This theory can be applied to the investment in Japan, too.

When we are making a property investment, we have to be in the right neighborhoods.

Our life and life of your family matter.

Choosing the right neighborhoods is one of keys for success in the investment.

In this regard, investing in anywhere Tokyo is very safe.

You don’t have to worry about the homicides here however, there are

some areas that are even safer than those among Tokyo 23 wards.

People in Tokyo is always very sensitive about the safety and security of

their house especially women who live alone.

If you want to buy a house or rental property, the crime rate can

be one of the most important considerations.

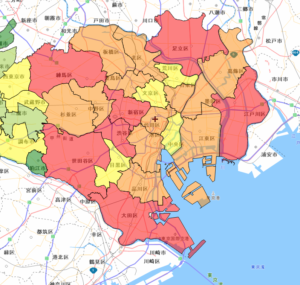

So Let’s say you want to buy a house in Tokyo, which ward is the safest to invest in terms of crime rate in Tokyo 23 wards ?

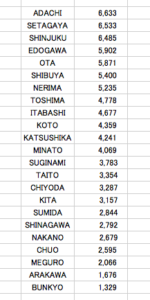

Please see the data showing the number of crimes in each Tokyo 23 ward.

Official statistics on crime of Tokyo

I know it is all in Japanese.

I looked into data on number of crimes committed which was announced by the Tokyo Metropolitan Police Department.

Number of crimes for each ward in 2017 :

(Source : Tokyo Metropolitan Police Department)

By image, the number of crimes in each ward is shown in the following map.

(Source : Tokyo Metropolitan Police Department)

Red is indicating more crimes and orange next. Yellow means less.

In terms of number of crimes. The following 5 wards are showing the worst numbers.

1 Adachi

2. Setagaya (where I live)

3. Shinjuku

4. Edogawa

5. Ota

So Adachi-ward is the most dangerous place to live ?

Not really.

Let’s look at crime rate per capita in each ward in 2017.

Number of crimes is so small in Tokyo that rate per capita is in the order of 0.01.

Chiyoda-ward is the highest in crimes followed by Shibuya-ward and Shinjuku-ward.

Bunkyo-ward, Setagata and Nerima are the safest.

Do you live in Chiyoda ? Don’t worry.

The data showed not only homicides but all sort of crimes such as

robbery, murder, assault ,sneak thief, snatchers, pickpockets and so on so forth.

Even in Chiyoda, there were only 7 robberies and 6 sneak thieves in entire 2017.

Also Chiyoda, Shibuya and Shinjuku are uniquely positioned as

number of population during the day is much larger in these wards.

Chiyoda, Shibuya and Shinjuku all have business, schools, entertainment districts and

people outside from the wards come to work, study, shop and eat/drink.

For example, Chiyoda’s population during the day is 17 times more than that of night time.

Likewise, Chuo :5 times, Shibuya : 2.5 time, Shinjuku: 2.3 times.

It is difficult to factor in such population movement but it is fair to say that

adjusted crime rate for Chiyoda, Shinjuku, Chuo, Minato can be halved of

the number in the chart.

Conclusion

Japan is safe so as Tokyo. Crime rate is extremely low compared with the international standards.

Crime rate is low in all 23 wards of Tokyo and there is no need to be seriously concerned about

the difference in crime rate.

Again, it’s important to remember that a higher crime rate doesn’t necessarily mean

it’s off limits to invest in.

However, if I had to choose, considering the commuting time for people who work in central districts ,

these prime Chuo, Chiyoda and Minto wards plus Shinjuku are still good areas to invest.

But price of properties in these wards have already gone up significantly and affordability is diminishing.

And in some districts such as Ginza(Chuo), homes are even less affordable now than they were in the bubble.

Taking the relative price per square meter, commuting time and crime rate into account,

I would venture to say that Bunkyo, Adachi, Koto will be nice places to invest in the future.

Again, it’s important to remember that a higher crime rate doesn’t necessarily mean

it’s off limits to invest in.

But what is critical is to know what you are going into before you actually get it.

Toshihiko Yamamoto

Real estate investing consultant and author.

Toshihiko is currently writing a book about the real estate investing in Japan

for foreign investors.

Founder of Yamamoto Property Advisory in Tokyo.

International property Investment consultant and licensed

real estate broker (Japan).

He serves the foreign companies and individuals to buy and sell

the real estates in Japan as well as own homes.

He holds a Bachelor’s degree in Economics from

Osaka Prefecture University in Japan

and a MBA from Bond University in Australia